How Virtual Accounts Work

How Virtual Accounts Work

Introduction

In today's rapidly evolving financial landscape, virtual accounts have emerged as a powerful tool for businesses and entrepreneurs operating globally. These digital financial tools are revolutionizing how companies manage international transactions, providing a streamlined approach to handling multiple currencies and payment methods. At Decent Hash, we've seen firsthand how virtual accounts are transforming business operations for our clients. This guide will break down exactly how virtual accounts work and why they're becoming essential for modern businesses.

What Are Virtual Accounts?

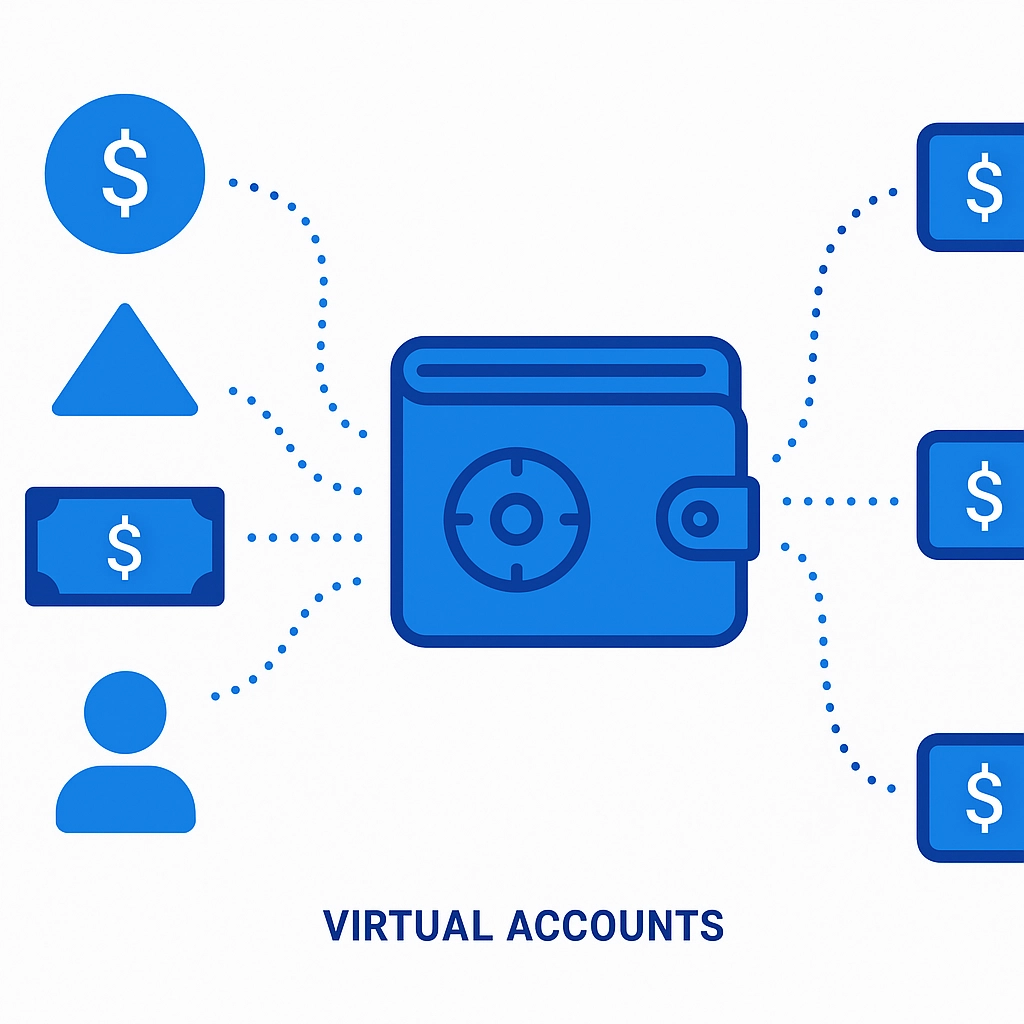

Virtual accounts are digital banking solutions that function as assignable accounts. Unlike traditional bank accounts, virtual accounts aren't designed to actually hold funds. Instead, they serve as identifiers or routing mechanisms that direct money to and from a master account while maintaining tracking and reconciliation.

Think of a virtual account as an email alias. Just as you might create multiple email addresses that all forward to your primary inbox for better organization, virtual accounts create multiple "addresses" for funds that all ultimately land in the same place—your primary account.

The Core Structure of Virtual Accounts

Virtual vs. Traditional Bank Accounts

Before diving deeper, let's clarify the key differences between virtual accounts and traditional bank accounts:

Virtual accounts excel in environments where transaction tracking, automated reconciliation, and global payment processing are priorities.

How Virtual Accounts Work: The Technical Foundation

At their core, virtual accounts operate on a simple but powerful concept:

Creation: A business establishes a primary account with a financial institution or platform like Decent Hash.

Virtual Account Generation: Multiple virtual accounts with unique identification numbers are created under this primary account.

Transaction Routing: When funds are sent to any of these virtual account numbers, the money is automatically routed to the primary account.

Metadata Tracking: Each transaction carries identifying information linked to its specific virtual account, enabling automatic categorization and reconciliation.

Reporting and Visibility: The system maintains separate ledgers for each virtual account while the actual funds remain pooled in the primary account.

This structure enables businesses to maintain the simplicity of a single account while gaining the organizational benefits of multiple accounts.

Decent Hash's Virtual Account Implementation

At Decent Hash, we've enhanced the standard virtual account model with cryptocurrency integration, creating a seamless bridge between traditional banking and digital assets. Our implementation follows a straightforward three-step process:

1. Receive Funds

When someone needs to pay you, they send money to your dedicated virtual bank account using familiar methods like standard wire transfers or ACH payments. This virtual account is linked to your Decent Hash profile but functions just like a traditional bank account number from the sender's perspective.

The beauty of this approach is that your clients, customers, or partners don't need to understand cryptocurrency or change their payment behaviors. They simply use the banking rails they're already comfortable with.

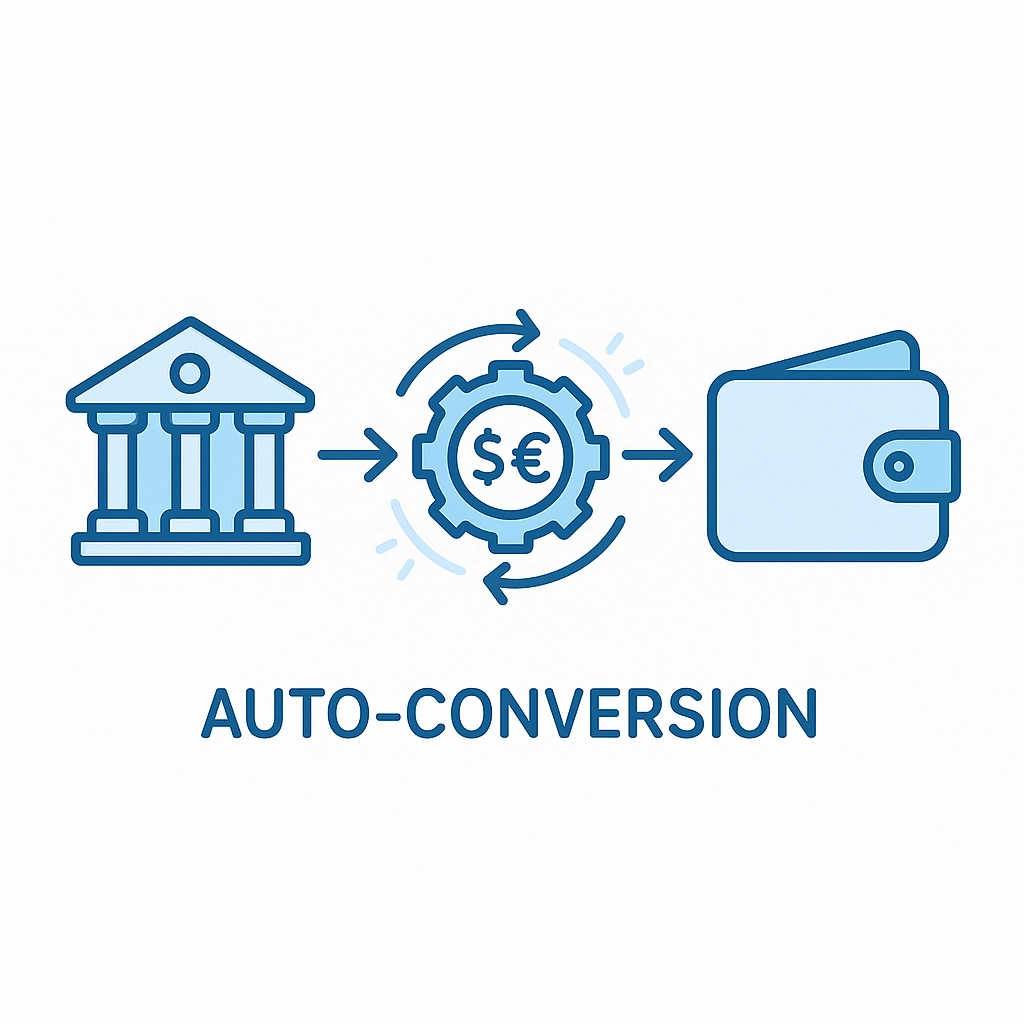

2. Auto Convert

Once funds arrive in your virtual account, our system springs into action. The incoming fiat currency (dollars, euros, etc.) is automatically converted to your preferred cryptocurrency at market rates. This conversion happens behind the scenes without requiring any action on your part.

You can configure which cryptocurrency you prefer (from stablecoins like USDC or USDT), and our system handles the conversion with minimal fees and optimal timing to ensure you get the best rates.

3. Send to Wallet

After conversion, the cryptocurrency is automatically transferred to your designated wallet address. This could be a wallet you maintain with Decent Hash or an external wallet you've specified. The entire process—from someone sending a traditional bank payment to you receiving cryptocurrency—happens automatically and typically completes within one business day.

Benefits of Virtual Accounts for Global Entrepreneurs

Virtual accounts offer numerous advantages that make them particularly valuable for businesses operating internationally:

1. Simplified Global Banking

Virtual accounts eliminate the need to open bank accounts in multiple countries. Instead, you can create virtual accounts that accept local payments in different regions while managing everything from a single platform.

2. Automated Reconciliation

One of the most powerful benefits is automatic payment matching. Each virtual account can be assigned to a specific customer, project, or revenue stream, making it immediately clear where payments are coming from without manual reconciliation work.

3. Reduced Administrative Overhead

By automating the tracking and categorization of incoming payments, virtual accounts significantly reduce the administrative work required to manage finances. This is especially valuable for businesses handling high transaction volumes.

4. Currency Flexibility

For businesses dealing with multiple currencies, virtual accounts provide a streamlined way to accept payments in various currencies while converting them to your preferred currency or cryptocurrency.

5. Enhanced Cash Flow Visibility

The structured nature of virtual accounts provides better visibility into cash flows across different business segments, improving financial planning and analysis.

6. Borderless Operations

Virtual accounts remove geographical limitations, allowing businesses to receive payments from anywhere in the world without establishing a physical presence in each location.

Common Use Cases for Virtual Accounts

Virtual accounts shine in numerous business scenarios:

Marketplace Platforms

Businesses that connect buyers and sellers can use virtual accounts to separate funds for each seller while managing a single primary account, simplifying commission calculations and payouts.

Subscription Businesses

Companies with recurring billing can assign a virtual account to each customer, making it easy to track payment status and manage renewals.

International Freelancers

Freelancers working with global clients can provide local payment options in various countries without maintaining multiple international bank accounts.

Property Management

Landlords and property managers can assign virtual accounts to different properties or tenants, instantly identifying the source of rent payments.

Setting Up Your First Virtual Account

Getting started with virtual accounts at Decent Hash is straightforward:

Create an Account: Sign up for a Decent Hash account and complete the verification process.

Select Your Preferences: Choose your preferred cryptocurrency for automatic conversion and specify your wallet destination.

Generate Virtual Accounts: Create virtual accounts based on your business needs—whether by customer, project, or revenue stream.

Share Payment Details: Provide your virtual account details to clients or integrate them into your invoicing system.

Monitor Automatically: Watch as payments arrive, convert, and deposit to your wallet without manual intervention.

Security Considerations

While virtual accounts offer convenience, security remains paramount. At Decent Hash, we implement multiple layers of protection:

Banking-grade encryption for all transaction data

Multi-factor authentication for account access

Regular security audits of our conversion and transfer systems

Compliance with financial regulations across jurisdictions

The Future of Virtual Accounts

As digital finance continues to evolve, virtual accounts are becoming increasingly sophisticated. We're seeing integration with:

Smart contracts for conditional payment routing

API-first architectures enabling seamless integration with business software

Advanced analytics providing deeper insights into payment patterns

Cross-border payment optimization reducing fees and settlement times

At Decent Hash, we're committed to staying at the forefront of these innovations, continuously enhancing our virtual account capabilities to provide maximum value to global entrepreneurs.

Conclusion

Virtual accounts represent a significant advancement in financial technology, bridging traditional banking systems with the efficiency of digital finance. By providing a structure that simplifies receiving, tracking, and managing payments while enabling automatic conversion to cryptocurrency, virtual accounts are becoming an essential tool for forward-thinking businesses.

Whether you're managing multiple revenue streams, operating across borders, or simply looking to streamline your financial operations, virtual accounts offer a powerful solution that combines the best of traditional and digital finance.

Ready to experience the benefits of virtual accounts with automatic cryptocurrency conversion? Visit Decent Hash to learn more about how our platform can transform your business finances.